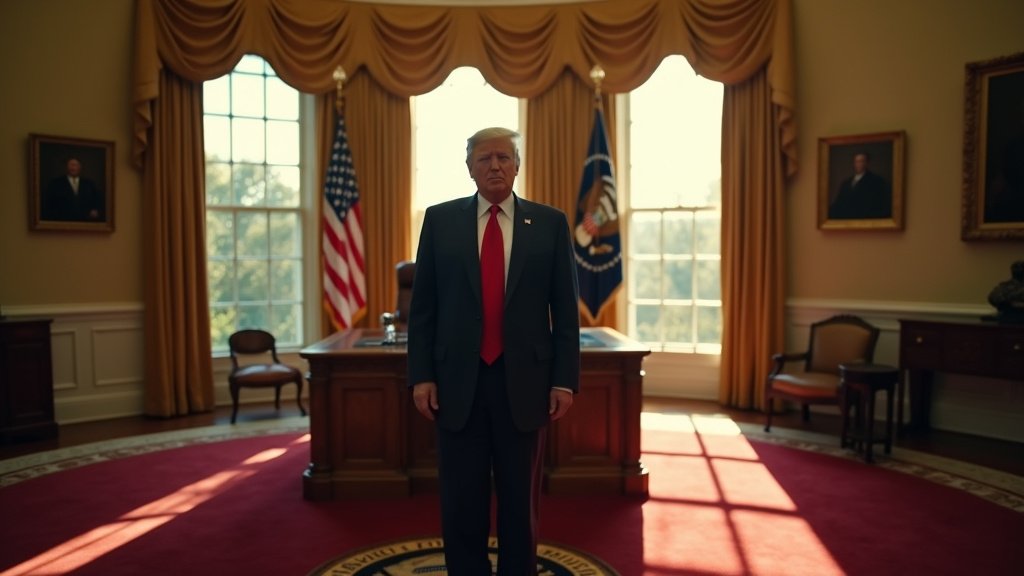

Washington D.C. – In a significant expansion of his administration’s protectionist trade agenda, U.S. President Donald Trump announced on Tuesday, July 8th, the immediate imposition of a 50 percent tariff on imported copper. The declaration, made during a Cabinet meeting held at the White House, was accompanied by a stark warning that duties on imported pharmaceuticals could escalate dramatically, potentially reaching as high as 200 percent.

The move signals a renewed push by the Trump administration to reshape global supply chains and boost domestic production across critical sectors, following previous tariff actions on goods like steel and aluminum.

Unpacking the Copper Tariff

The 50 percent tariff on imported copper represents a substantial hurdle for international suppliers and domestic industries reliant on the metal. Copper is a foundational material with widespread applications, particularly vital in rapidly growing sectors such as electric vehicles (EVs), renewable energy infrastructure, and defense systems. The administration’s stated objective behind this tariff is to incentivize and boost domestic copper production, reducing reliance on foreign sources.

The United States imports approximately half of its annual copper needs, making the 50 percent duty a potentially disruptive measure for both foreign exporters and American manufacturers. Major suppliers of copper to the U.S. market include Chile, Canada, and Peru. These nations are now facing a significant challenge to the economics of their copper trade with the United States.

Commerce Secretary Howard Lutnick later provided clarity regarding the implementation timeline for the copper tariff. Speaking to reporters, Secretary Lutnick indicated that the new duty would likely be implemented relatively swiftly, suggesting it could take effect by the end of July or no later than August 1. This rapid timeline underscores the administration’s apparent urgency in reshaping the copper market.

The announcement of the 50 percent copper tariff had an almost immediate and dramatic impact on financial markets. Following President Trump’s comments, U.S. Comex copper futures saw a significant jump, rising by over 12 percent. This surge propelled futures prices to a record high, reflecting market expectations of constrained supply and higher domestic prices resulting from the hefty tariff.

This tariff adds to existing duties on imported steel and aluminum, reinforcing a consistent pattern of using trade barriers to protect or stimulate domestic heavy industries. While the administration posits that this will bolster American jobs and production, industry groups often warn of increased costs for downstream manufacturers and potential retaliatory measures from trading partners.

Pharmaceutical Duties: A Potential 200% Surge

Perhaps even more striking than the immediate copper tariff is the proposed escalation of duties on imported pharmaceuticals. President Trump stated that tariffs on medicines brought into the U.S. could increase by as much as 200 percent. This potential tariff hike targets the global pharmaceutical supply chain, much of which is based overseas.

The rationale articulated by the President is to compel pharmaceutical manufacturers to relocate their production facilities to the United States. To facilitate this ambitious shift, Trump indicated that companies would be granted an adjustment period of approximately 12 to 18 months to move their manufacturing operations to American soil before the high tariffs on imported medicines would take effect.

The pharmaceutical industry is characterized by complex, highly regulated, and capital-intensive manufacturing processes. Relocating production facilities, especially those involved in creating active pharmaceutical ingredients (APIs) or sterile finished products, is a lengthy undertaking often requiring years of planning, construction, validation, and regulatory approval. A timeline of 12 to 18 months is viewed by many industry experts as exceptionally challenging, if not entirely unrealistic, for a wholesale shift of complex manufacturing operations.

The potential for a 200 percent tariff raises significant concerns about the potential impact on the cost and availability of prescription drugs in the United States. Higher import duties could translate directly into higher prices for consumers, potentially impacting patient access to essential medications. It also raises questions about the diversity and resilience of the U.S. drug supply chain, which currently relies heavily on global sources.

Broader Tariff Landscape and Economic Implications

The announced and proposed tariffs on copper and pharmaceuticals are part of a broader trade strategy discussed by the administration. President Trump also mentioned plans for introducing new tariffs on imported semiconductors and potentially other categories of goods. This indicates a comprehensive approach aimed at reducing import dependence across multiple strategic sectors.

Secretary Lutnick’s remarks provided necessary context regarding the procedural aspects of these potential tariffs. He clarified that final decisions regarding the specifics and implementation of pharmaceutical and semiconductor tariffs are pending the completion of ongoing studies. These studies are expected to conclude later in July. Following their completion, President Trump would then review the findings and set the specific policies, suggesting that the details and final scope of these duties are not yet set in stone, unlike the copper tariff which appears to have a more immediate implementation path.

The administration’s repeated use of tariffs as a trade tool aligns with its “America First” economic policy, prioritizing domestic industry and employment over traditional free-trade agreements. While proponents argue these measures protect American jobs and strategic capabilities, critics point to potential negative consequences, including increased costs for consumers and businesses, reduced competitiveness for export-oriented industries affected by higher input costs, and the risk of retaliatory tariffs from trade partners, which could harm U.S. exporters.

Global Reactions and Supplier Impacts

The tariff announcements have immediate implications for key trading partners. For the copper tariff, countries like Chile, Canada, and Peru, major suppliers to the U.S. market, will face reduced demand or significantly less favorable terms for their exports. This could pressure their mining sectors and national economies.

The potential pharmaceutical tariffs are particularly significant for countries with large pharmaceutical export industries supplying the U.S. market. India stands out in this context. According to official figures, India was the largest overseas market for U.S. pharmaceutical imports, valued at $9.8 billion in Fiscal Year 2025. India is also a major copper exporter to the United States, albeit smaller in value than the pharmaceutical trade.

A 200 percent tariff on pharmaceuticals would profoundly impact the U.S.-India trade relationship in this critical sector. It could force Indian manufacturers to find alternative markets or attempt the difficult and costly process of establishing U.S. production facilities within the proposed tight deadline. For India, which has positioned itself as a global pharmaceutical manufacturing hub, such a tariff represents a major challenge to its export economy.

Beyond India, other significant suppliers of pharmaceuticals to the U.S., including countries in Europe and Asia, would also be impacted by potential duties, forcing a re-evaluation of their export strategies and supply chain structures.

Next Steps and Uncertainty

The coming weeks will be critical in determining the full scope and impact of these trade measures. While the 50 percent copper tariff appears set for implementation soon (likely by the end of July or August 1, as estimated by Secretary Lutnick), the details and final decision regarding the potentially far-reaching pharmaceutical and semiconductor tariffs remain contingent on the completion of administration studies later in July and subsequent policy setting by President Trump.

The proposed 12-18 month window for pharmaceutical companies to relocate production adds another layer of complexity and uncertainty, raising questions about the feasibility of such a rapid transition and the potential consequences if companies cannot meet the deadline.

Markets, industries, and international trading partners will be closely watching for the finalized policies and implementation details, particularly concerning the significant proposed tariffs on pharmaceuticals and semiconductors, which could trigger substantial shifts in global trade flows and supply chain configurations.

The announcements underscore the administration’s continued commitment to using tariffs as a primary tool for achieving its economic and industrial policy goals, setting the stage for potential disruptions and adjustments in global trade relationships in the months ahead.