Markets across Wall Street experienced a sharp decline on Wednesday, March 26, 2025, as investor apprehension mounted ahead of a highly anticipated announcement from President Trump. The potential imposition of new tariffs on imported automobiles cast a shadow over trading floors, threatening to derail a fragile recovery that had begun following a month-long market selloff.

The downturn was particularly pronounced within the technology sector, where several bellwether stocks suffered significant losses, leading the broader market slide. Companies deeply integrated into artificial intelligence infrastructure and consumer technology faced intense selling pressure throughout the trading session.

The Looming Tariff Threat

The primary catalyst for Wednesday’s market unease was the impending decision from the White House regarding automobile tariffs. President Trump’s administration had signaled that an announcement was imminent, sparking concerns across various industries. The potential for tariffs on vehicles and automotive parts introduces considerable uncertainty into global supply chains and could significantly impact the profitability of multinational corporations, particularly those with substantial exposure to the automotive sector, either directly or indirectly. Market participants were closely watching for details, fearing that protectionist measures could escalate trade tensions and dampen economic growth prospects, thereby challenging the market’s recent upward momentum.

Tech Sector Takes a Hit

The technology sector bore the brunt of the day’s selloff, with major players seeing substantial valuation decreases. While several tech giants felt the pressure, companies like Tesla and Nvidia (NVDA) were prominent among those leading the decline. The selloff in technology stocks reflected broader investor sentiment, which appeared to be rotating away from growth-oriented assets in favor of more defensive positions amid the macroeconomic uncertainty posed by potential trade actions.

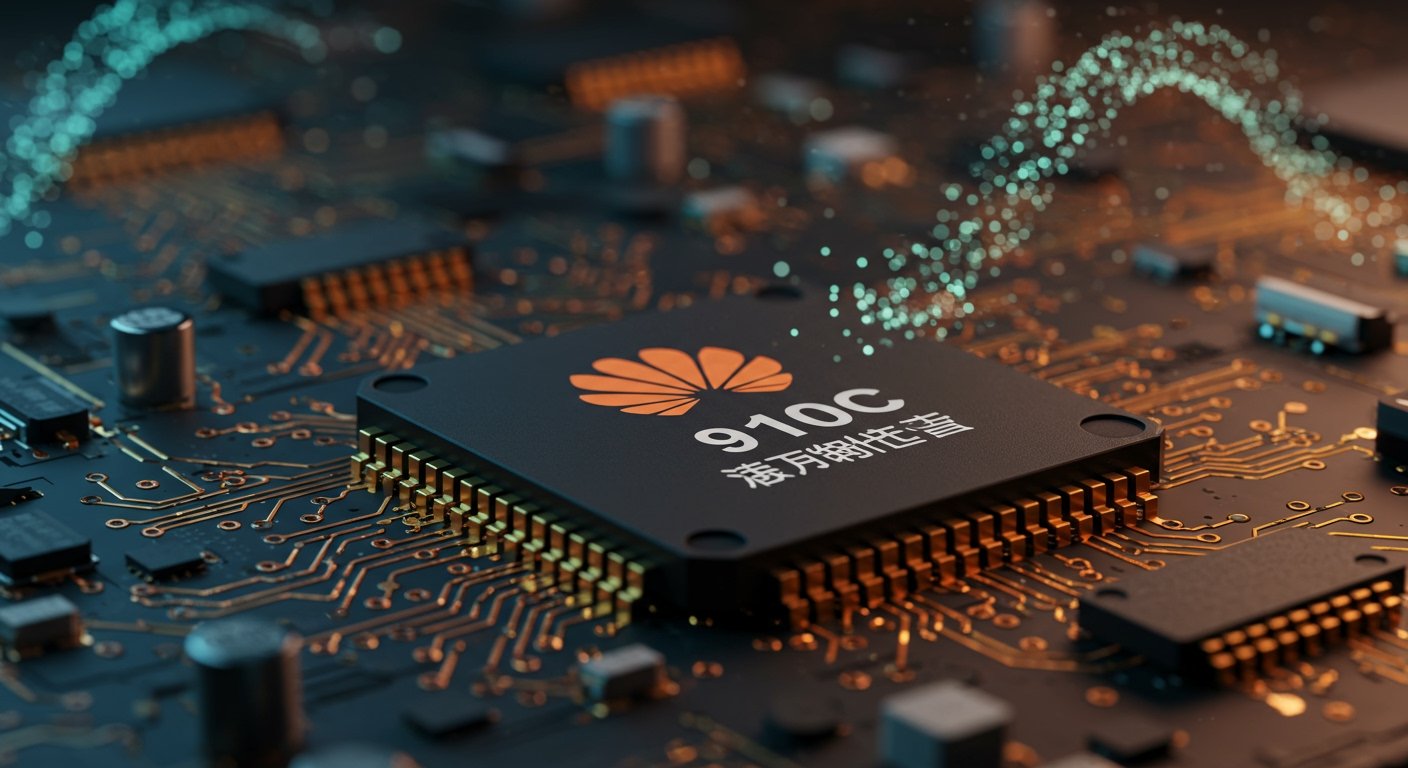

Specific companies tied to the burgeoning field of artificial intelligence infrastructure were hit particularly hard, highlighting investor sensitivity to both regulatory risks and shifts in growth expectations. This segment of the market, which has seen significant gains in recent months, proved vulnerable to profit-taking and reassessment.

Nvidia and China Concerns

Shares of Nvidia (NVDA), a dominant force in the graphics processing unit market critical for AI computing, notably slipped by 5.7% on Wednesday. The decline in Nvidia’s stock was reportedly fueled by persistent concerns surrounding potential additional restrictions on the sale of advanced AI chips to China. Geopolitical tensions and the possibility of expanding export controls have weighed on investor confidence in companies with significant business ties to the Chinese market, creating headwinds despite strong underlying demand for AI hardware.

AI Infrastructure Providers Stumble

The ripple effects of the tech selloff extended to companies providing essential infrastructure for AI data centers. Vistra (VST), a utility company recognized for its role in supplying power to these energy-intensive facilities, saw its shares drop by 5.9%. The decline in Vistra’s stock appeared linked to the broader downturn in AI-related equities, suggesting that investors were reassessing the pace or certainty of growth in this segment.

Similarly, Vertiv Holdings (VRT), a manufacturer specializing in cooling systems vital for maintaining optimal operating temperatures in AI data centers, experienced a significant slump, falling by over 10%. The sharp decline in Vertiv’s share price was exacerbated by a research note from Barclays analysts, who reduced their price target for the company. Analyst downgrades and price target reductions can often trigger sharp movements in stock prices, particularly for companies whose valuations are closely tied to future growth projections.

Market Recovery Under Threat

Wednesday’s decline represented a significant setback for the market, which had been showing signs of recovery after enduring a month-long selloff. The anticipation of President Trump’s tariff announcement injected a new layer of volatility and uncertainty, prompting investors to exercise caution and reduce exposure to riskier assets like technology stocks. The market’s ability to sustain its recovery path now hinges significantly on the details and implications of the forthcoming trade policy announcement.

The confluence of macroeconomic policy uncertainty, sector-specific regulatory risks, and negative analyst sentiment created a challenging trading environment on March 26, 2025, underscoring the fragility of the market’s current footing.