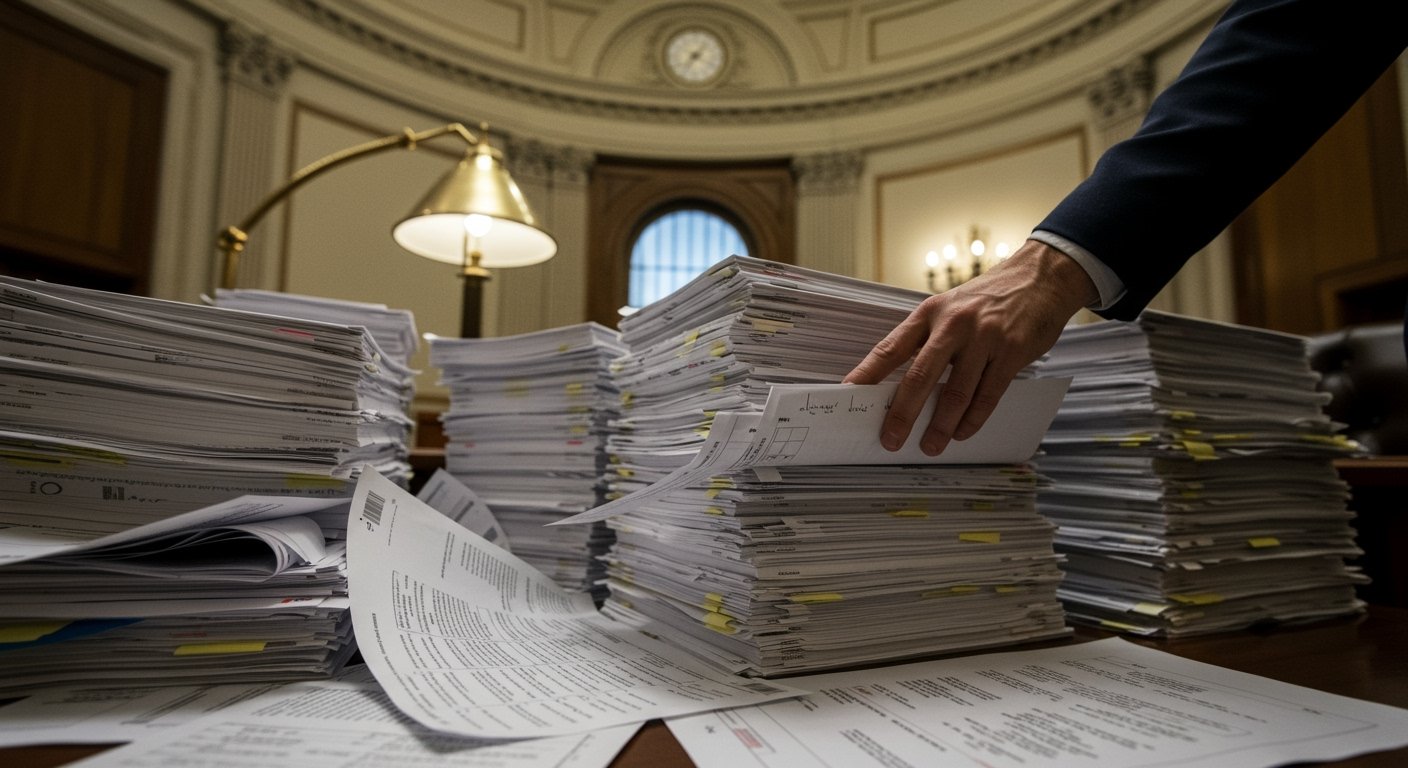

Washington, D.C. – Republican lawmakers in the House of Representatives have unveiled a fiscal blueprint that proposes significant reductions to Medicaid spending, explicitly linking these cuts to efforts to offset the cost of substantial tax reductions primarily benefiting wealthy individuals and corporations.

The plan, which has drawn sharp criticism from healthcare advocates and Democrats, includes an estimated $880 billion in cuts to the federal Medicaid program. Simultaneously, it outlines $4.5 trillion in tax breaks, a significant portion of which is directed towards higher-income taxpayers and businesses.

Understanding the Proposal

The core of the Republican proposal involves a dramatic reshaping of federal spending priorities. By reducing the amount allocated to Medicaid, proponents argue they are creating fiscal space necessary to implement widespread tax cuts they contend will stimulate the economy. However, critics argue this approach represents a transfer of wealth from vulnerable populations who rely on Medicaid for essential healthcare services to the nation’s wealthiest.

The proposed $4.5 trillion in tax breaks follows previous tax reform efforts and seeks to make many of those changes permanent while potentially introducing new reductions. The stated intention behind pairing these tax cuts with Medicaid reductions is to address concerns about the national debt and fiscal responsibility, asserting that spending must be curtailed to afford lower taxes.

Projected Impact on Healthcare Access

An analysis from the Congressional Budget Office (CBO), the non-partisan agency providing budgetary and economic information to Congress, offers a stark projection of the human cost of the proposed Medicaid cuts. According to CBO estimates, the planned $880 billion reduction in federal Medicaid funding would result in 8.6 million people losing their health insurance coverage.

Medicaid is a critical lifeline for millions of Americans, providing comprehensive health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. It is jointly funded by the federal government and states, and its beneficiaries often have limited access to other forms of affordable healthcare.

The loss of coverage for 8.6 million individuals, as projected by the CBO, would likely strain safety-net hospitals and clinics, increase uncompensated care costs, and potentially lead to worse health outcomes for those who become uninsured. This projection underscores the profound real-world consequences of the proposed budget cuts.

Political Framing and Reactions

The Republican plan has ignited fierce debate on Capitol Hill and across the country. Opponents have framed the proposal in stark terms, arguing it prioritizes tax benefits for the rich over healthcare for the poor and vulnerable. The sentiment captured in the phrase “This Is What Oligarchy Is About” has been voiced by critics, reflecting the view that the plan exemplifies governance that serves the interests of a small, wealthy elite at the expense of the broader population and those in need.

Supporters of the plan counter that reducing government spending, including on entitlement programs like Medicaid, is necessary for long-term fiscal health. They argue that tax cuts stimulate economic growth, ultimately benefiting all Americans, although this assertion is disputed by economists who analyze the distributional effects of the proposed cuts.

The Role of the CBO

The CBO’s analysis plays a crucial role in this debate, providing independent projections based on current law and the specifics of proposed legislation. While their projections are estimates and subject to some degree of uncertainty, the CBO’s figure of 8.6 million people losing coverage provides a non-partisan metric for understanding the potential scale of impact associated with the proposed $880 billion in Medicaid cuts.

Path Forward

The proposal represents a significant policy statement from House Republicans but faces considerable hurdles to becoming law. It would need to pass the House, overcome likely opposition in the Senate, and potentially face a presidential veto. The plan sets the stage for contentious budget negotiations and highlights fundamental disagreements over the government’s role in providing a social safety net and the most effective means of fostering economic prosperity.

The debate is expected to intensify as more detailed analyses of the proposal’s impact on various sectors of the economy and population are released. The focus remains squarely on the projected trade-off: substantial tax benefits for the wealthy funded, in part, by significant reductions in healthcare access for millions of low-income Americans.