New York — U.S. equity markets posted their most robust monthly performance since late 2023 in May 2025, demonstrating significant resilience despite ongoing trade tensions and persistent tariff uncertainties. Major indices recorded substantial gains, signaling renewed investor optimism driven by a confluence of economic factors and sector-specific strength.

The benchmark S&P 500 index saw an increase of more than 6% during the month. The technology-heavy Nasdaq Composite surged approximately 9.6%, while the blue-chip Dow Jones Industrial Average advanced around 4%. This widespread upward movement marked a notable turnaround for markets that had faced volatility earlier in the year.

Navigating Trade Policy and Tariff Dynamics

The market’s upward trajectory occurred against a backdrop of complex global trade dynamics, particularly concerning U.S.-China relations. While broader trade tensions persisted, a temporary easing measure provided a degree of relief to investors.

Specifically, a 90-day tariff reduction agreement between the United States and China came into effect starting May 14. This accord temporarily lowered reciprocal tariffs from rates as high as 125% down to a uniform 10% on a significant portion of goods traded between the two nations. However, existing 20% tariffs related to fentanyl and fentanyl precursors remained in place. Consequently, the effective tariff rate on most Chinese imports subject to these measures settled at approximately 30%, a blend of the new 10% rate plus the standing 20% levy, demonstrating a nuanced shift rather than a complete removal of barriers.

Underlying Economic Strength Provides Support

Beyond trade policy, several fundamental economic indicators contributed to the positive market sentiment. Solid employment data released during May suggested continued resilience in the U.S. labor market, alleviating concerns about a sharp economic slowdown. Concurrently, measures of inflation indicated a further easing of price pressures, increasing hopes that the Federal Reserve might consider adjustments to monetary policy settings in the future.

These signs of economic stability and potential disinflation provided a supportive environment for corporate earnings and consumer spending forecasts, bolstering investor confidence in the underlying health of the economy.

Technology Sector Leads the Charge

A significant driver of May’s gains was a pronounced rebound in the technology sector. Strong quarterly earnings reports from several major technology companies exceeded market expectations, particularly those with exposure to the rapidly evolving field of artificial intelligence.

Leading the surge were companies such as Nvidia, which continued to benefit from robust demand for its AI-related hardware, alongside other key players like Constellation Energy and Super Micro Computer, also highlighted for their performance linked to technological advancements and infrastructure.

This wave of positive earnings and optimistic outlooks for AI-driven growth fueled substantial buying activity in tech stocks, contributing significantly to the Nasdaq’s standout performance and providing momentum for the broader market indices.

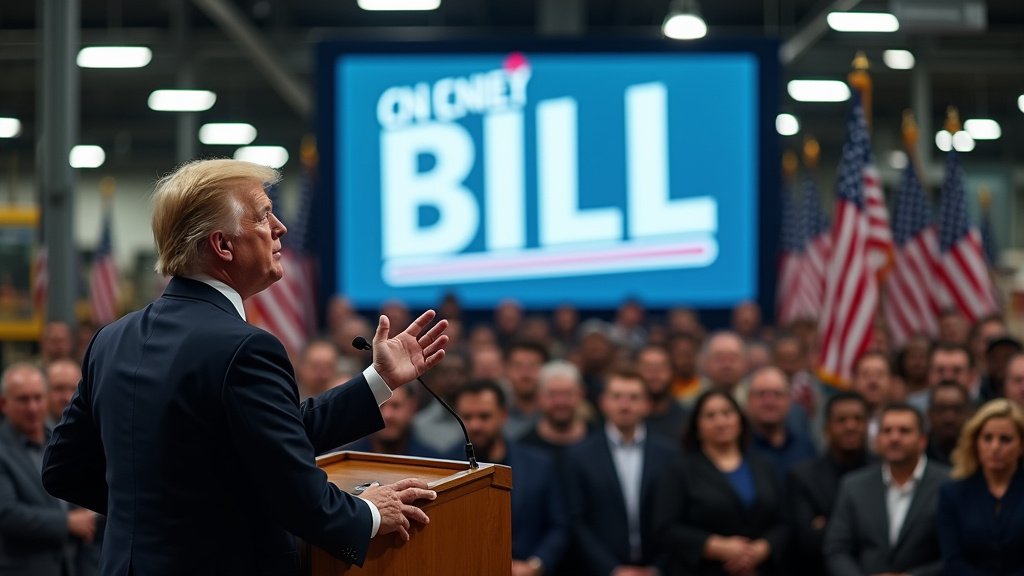

Legislative Developments and Expert Perspectives

Further contributing to investor sentiment was progress reported in Congress towards a significant tax-cutting bill. While details and passage timelines remained subject to political negotiation, the prospect of potential fiscal stimulus through tax reductions added another layer of optimism regarding future corporate profitability and economic activity.

Amidst these positive market movements, prominent figures continued to highlight potential risks. JPMorgan Chase CEO Jamie Dimon, for instance, reiterated the critical need for swift government action to resolve ongoing U.S.-China disputes. He underscored the importance of addressing these geopolitical risks proactively, suggesting that unresolved international tensions could pose challenges to future market stability and global economic growth despite the recent positive performance.