Major U.S. stock indexes exhibited a volatile session on Monday, March 31, 2025, ultimately closing mixed as markets staged a recovery from significant early morning declines. The turnaround occurred as investors digested the implications of anticipated announcements from the Trump administration regarding a new set of tariffs.

The benchmark S&P 500 index managed a gain of 0.6% by the close, while the Dow Jones Industrial Average saw a more robust rise of 1%. In contrast, the Nasdaq Composite, heavily weighted in technology stocks, concluded the day slightly lower, dipping 0.1%.

This market oscillation followed a sharp plunge on the previous trading day, Friday, March 28. That earlier selloff was largely attributed to the release of higher-than-expected inflation figures coupled with disheartening weak consumer sentiment data, collectively fueling concerns about the economic outlook.

A Difficult Month Concludes

Monday’s close marked the end of a challenging month for Wall Street. All three major indexes concluded March with substantial monthly declines, registering their worst one-month performance since late 2022. The Dow Jones Industrial Average fell 4.2% for the month, the S&P 500 shed 5.8%, and the Nasdaq Composite experienced the steepest decline, dropping 8.2%.

Tariff Uncertainty Looms

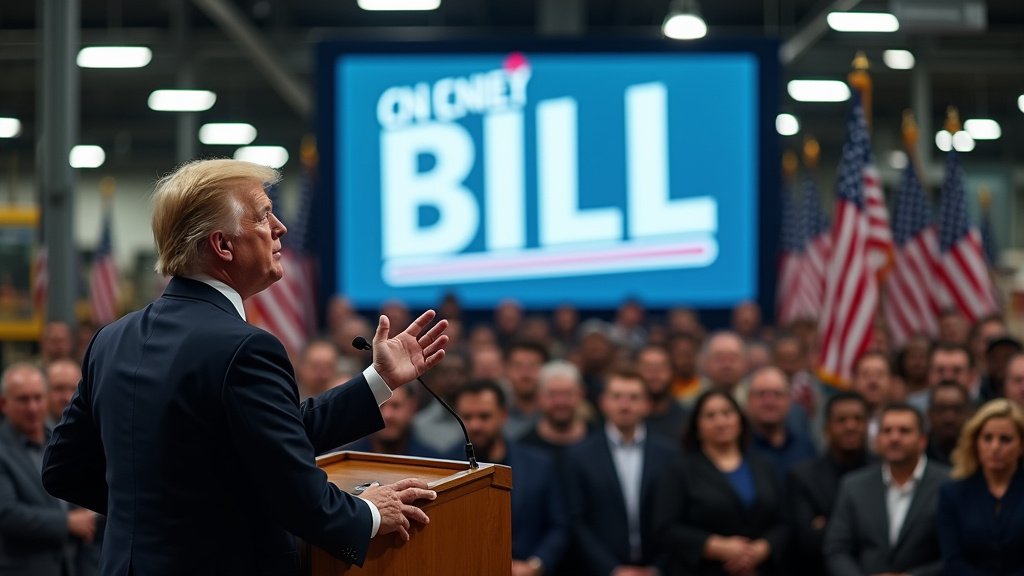

A key factor influencing market sentiment on Monday was the impending announcement from President Trump. The president is expected to detail broad reciprocal tariffs targeting countries that impose levies on U.S. exports. These new duties are scheduled to become effective on April 2, a date that President Trump has referred to as “Liberation Day.”

The prospect of escalating trade tensions and their potential impact on global supply chains and corporate earnings weighed on investors, contributing to the initial market weakness before the late-day recovery.

Bond Market Steadies

In the bond markets, the yield on the bellwether 10-year Treasury note showed some easing on Monday. In late trading, the yield stood at 4.21%, down from 4.26% at Friday’s close. This level brought the yield near its lowest point of the month, which was 4.18%, suggesting continued demand for safer assets amidst equity market volatility and economic uncertainty.

Mixed Fortunes for Individual Stocks

Performance among individual equities was varied. Mega-cap technology shares, which had been significant drivers of previous market gains, were mostly lower. Prominent names like Tesla (TSLA), Nvidia (NVDA), Broadcom (AVGO), Microsoft (MSFT), and Amazon (AMZN) all saw declines during the session.

Bucking the trend among its tech peers, Apple (AAPL) shares posted a gain of nearly 2%.

In other notable stock movements, Moderna (MRNA) shares fell sharply, dropping nearly 9%. The decline followed news of the resignation of the U.S. Food and Drug Administration’s (FDA) vaccine chief, Peter Marks. Reports indicated that Marks’ departure was reportedly due to conflicts with Health and Human Services Secretary Robert F. Kennedy Jr., raising questions about leadership stability at a key health regulatory body.

Commodities and Cryptocurrency

The commodities markets saw upward movement. Gold futures increased by 1.4%, trading near $3,160 an ounce and reportedly reaching record levels. West Texas Intermediate (WTI) crude oil futures also climbed, gaining 2.9% to settle at $71.40 per barrel.

The cryptocurrency market remained active, with Bitcoin trading around $82,400.

The close of March finds U.S. equity markets navigating significant policy anticipation and grappling with the fallout from recent economic data, setting a cautious tone as participants look ahead to the second quarter.